Like many small business owners, my journey has been a lot different from the one I imagined. I planned to spend six years in New York City after law school, building my skills and resume. Then, I expected to open my own firm in a smaller city. After all, if I could make it here, I could make it anywhere. Right? Little did I know that I would be launching this law firm 16 months after I was licensed or that I would be doing it in the Big Apple. It was another year or two before I started thinking of the firm as a small business.

Youth, energy, and naivete have their benefits. Had I realized how much I still needed to learn about running a small business, I might have waited so long that it never happened. I am grateful for the mentors who encouraged me to leap before the net appeared. I also appreciate the resources I have accumulated. They’ve gotten me through some rough times. Many of you are among them, and I am deeply grateful for you. This post is one small way I can give back to you and your small business clients that need resources.

How to Think About What You Need

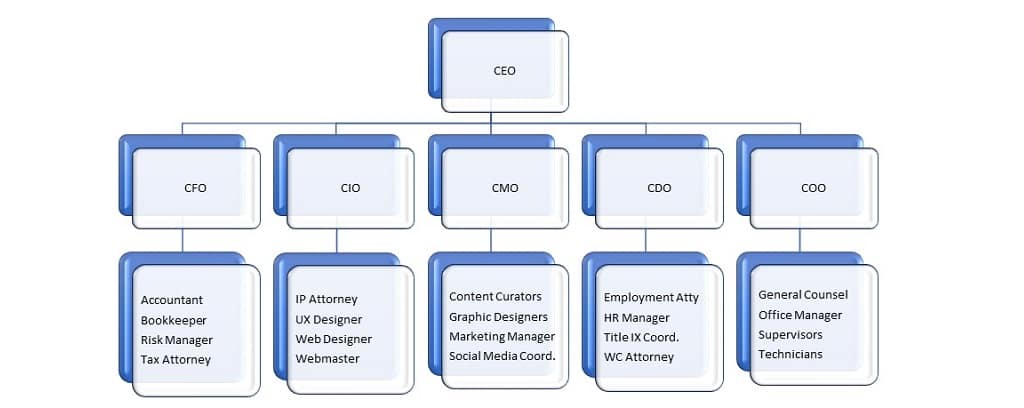

Having come from a corporate background before law school, I tend to think in terms of the organizational chart when identifying which roles I need to fill at various times. I use a combination of employees and independent contractors or freelancers, depending on the needs of the business. Although I advise regularly about the perils of worker misclassification, I am not opposed to hiring truly independent businesses and entering contracts with them for services I don’t provide in my business. Most business experts will tell you to hire people better than you at the work you hire them to do, and I agree.

When planning your small business resources, think like a Fortune 500 company. There are usually at least five departments under the Chief Executive Officer, each focusing on critical functions like Diversity, Finance, Information, Marketing, and Operations. In ideal situations, the officers that oversee each of these departments are supported by managers, technicians, and assistants. But you will often fill a lot of these roles when starting up.

Identify the areas in which you lack competency and fill those positions first. Many will be filled by outside, licensed professionals like accountants and attorneys who remain independent for the life of your business. Others will be so integral to your business that you will need to make them employees.

Contracting with Licensed Professionals

Interview at least three people or firms for each of the roles you need to fill. To get you started, I have provided the names some of the professionals I have relationships with. Among other things, you will need to ask them about their experience in your industry, with businesses your size and tenure. If there is a specific issue or project you want them to work on, ensure they have experience with similar ones and are willing to discuss with you how they will approach it to your satisfaction. Also, read their reviews online and make sure you feel comfortable discussing some of the most challenging issues in your business. These relationships are dependent upon mutual trust and respect.

Accountants

- Joseph Calvo, CPA, Joseph Calvo & Co. P.C.

- Allan J. Rolnick, CPA

- Terrell Turner, CPA, TL Turner Group

Bookkeepers

- Gabriella Callender, Go Gabby Bookkeeping

- Kelly Gonsalves, Totally Booked Bookkeeping

- Jon Blumberg, Profitas LLC

One caveat with outsourcing your bookkeeping services: Make sure you know whether the bookkeepers assigned are employees of the business you contract with, rather than independent contractors the business does not control. This is especially important when you are working with them virtually. Don’t give access to your bank accounts and other financial information to just anyone!

Employment Attorneys

- Joseph Harris, Esq., Barton LLP

- Eric M. Sarver, Sarver Law Firm, PLLC

- Alison Greenberg, Esq.

General Counsel

- Vaughn Buffalo, Esq., Buffalo & Associates LLC

- Jeffrey K. Davis, Esq., Davis & Associates PC

- Everett Carbajal, Esq., The Carbajal Law Firm PC

Franchise Attorneys

- Michael Einbinder or Terrence Dunn, Einbinder & Dunn LLP

Intellectual Property Attorneys

- Renee Duff, Esq., Nolte IP Law Group

- Amy B. Goldsmith, Esq. (Patents), Tarter, Krinsky & Drogin

- William R. Samuels, Esq., Warshaw Burstein LLP

- Michael D. Steger, Esq. (Trademarks and Copyrights)

Payroll Services

- Lauren Folland, Paychex

- Ian Steinberg, Nest Payroll (Domestic Employers)

Risk Managers

- Ebru Craft, My Risk Manager

- John Shelonko, Risk Management Consultant

- Michael Wiebe, Wiebe & Associates LLC

Tax Attorneys

- Yvonne Cort, Esq., Capell Barnett Matalon & Schoenfeld LLP

- Allan R. Pearlman, Esq.

- William M. Funk, Esq.

Workers Compensation Attorneys

Under your WC insurance contract, the carrier has a duty to defend you, which means counsel will be assigned for any litigated claims against your business. This benefit alone often makes the cost of the insurance worthwhile. More importantly, you are required to provide Disability, Paid Family Leave, and WC insurance for your employees–including those you mistakenly classified as independent contractors. Penalties for not providing the mandatory insurance accumulate at a rate of $2,000.00 for every 10-day period you do not have insurance.

It’s far wiser to get the insurance than to risk the penalties and cost of claims, which often exceed $60,000.00 for medical expenses and lost wages.

Contracting with Other Independent Businesses

I defend a lot of employers who get the independent contractor relationship wrong. By the time most of them come to me, their penalties have accumulated and are $16,000.00 or more. Few have that kind of money in any cash reserves, especially right now.

I created an online resource to help employers self-audit their worker classifications. I’ll still help resolve the penalties, if you get a penalty notice, but let’s do everything we can to make sure you’re in compliance and never have to deal with that.

Hiring W-2 Employees

There is no such thing as a 1099-MISC Employee. Your workers are either on your payroll and provided DB, PFL, Unemployment, and WC insurance, or they are independent business owners with contracts to perform services your business does not.

I’ve made my share of hiring and management mistakes with employees, but I’ve learned to continuously improve. So can you. Of course, if you need help at anytime throughout the employment relationship, please reach out.

Getting Free and Low-Cost Services

I am a big fan of taking advantage of free and low-cost options before you pay for someone to take something completely off your hands. That will require more effort from you, but your understanding of how all the moving parts come together can make a huge difference in your decisions going forward. There are a lot of people branding themselves as experts. You are less likely to waste time and money on them when you’ve done your homework, including by learning the basics of key business areas. Some of the places you can do this are:

- Create a Work and a Life You Love with 15 Hours Per Week

- Dan Miller’s Entrepreneur Checklist

- The Entrepreneur’s Prenup

- New York City Small Business Services

- New York City Bar Association

- Three Resources to Help You Find Purposeful Work

- SCORE

- Small Business Administration

- Your Kickstart Guide to Starting an Online Business

- Volunteer Lawyers for the Arts

Need more guidance on worker classifications?

Even the Smallest Businesses Benefit from Boards of Advisors